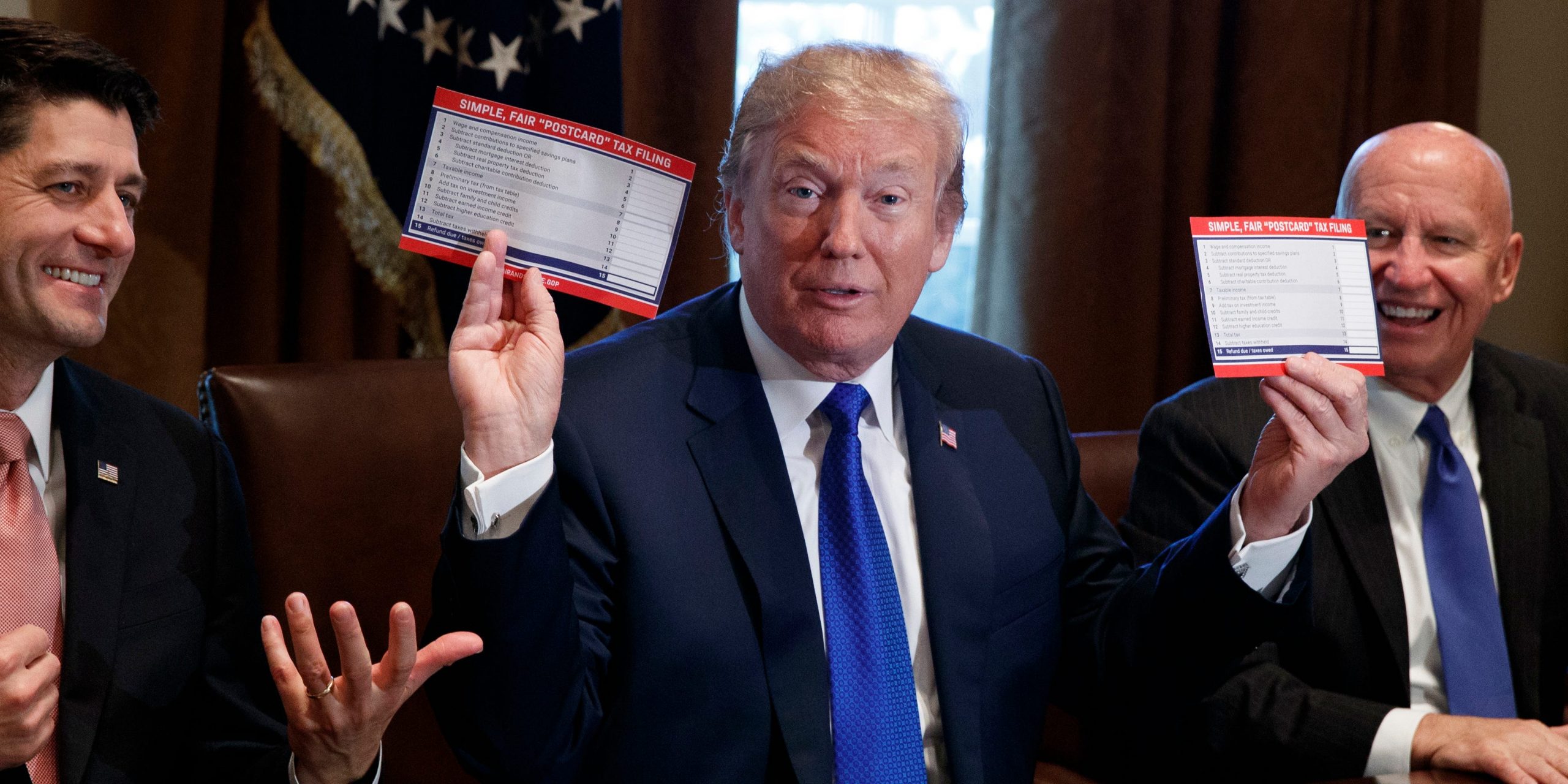

Evan Vucci/AP

- Many CEOs are fighting President Joe Biden's planned corporate tax hike.

- CEOs surveyed by Business Roundtable say reversing Trump's 2017 cuts boosted growth and employment.

- Data disagrees, showing the Trump cuts did little to stimulate the US economy despite costing trillions.

- See more stories on Insider's business page.

The inflation debate is dead. Long live the tax-hike debate.

President Joe Biden's spending spree was just getting started when he signed a $1.9 trillion stimulus into law on March 11. The administration now aims to spend up to $4 trillion more, split between two infrastructure packages.

Included in the proposal are tax hikes set to offset most of the new spending. Biden aims to lift the corporate tax rate to 28%, implement a global minimum corporate tax rate, and lift federal income taxes on households earning more than $400,000. The measures would undo some of the key elements of President Donald Trump's 2017 tax cuts, which is setting up a new argument between economists and business leaders.

In one corner, 98% of CEOs surveyed by the Business Round Table said Biden's proposed hikes would have a "moderate" to "very" significant negative impact on competitiveness. About 66% said the changes would stifle wage growth in the US, and more than seven in 10 said it would make hiring more difficult.

"As we look toward recovering from the COVID-19 pandemic, keeping competitive tax policies in place is needed to help reinvigorate the US economy and lead to more opportunity for Americans," Gregory J. Hayes, chief executive of Raytheon and chair of the Business Round Table Tax and Fiscal Policy Committee, said in a statement.

The 2017 cuts drove economic growth before the pandemic, dragged the unemployment rate to a 50-year low, and lifted middle-class wages, Hayes added.

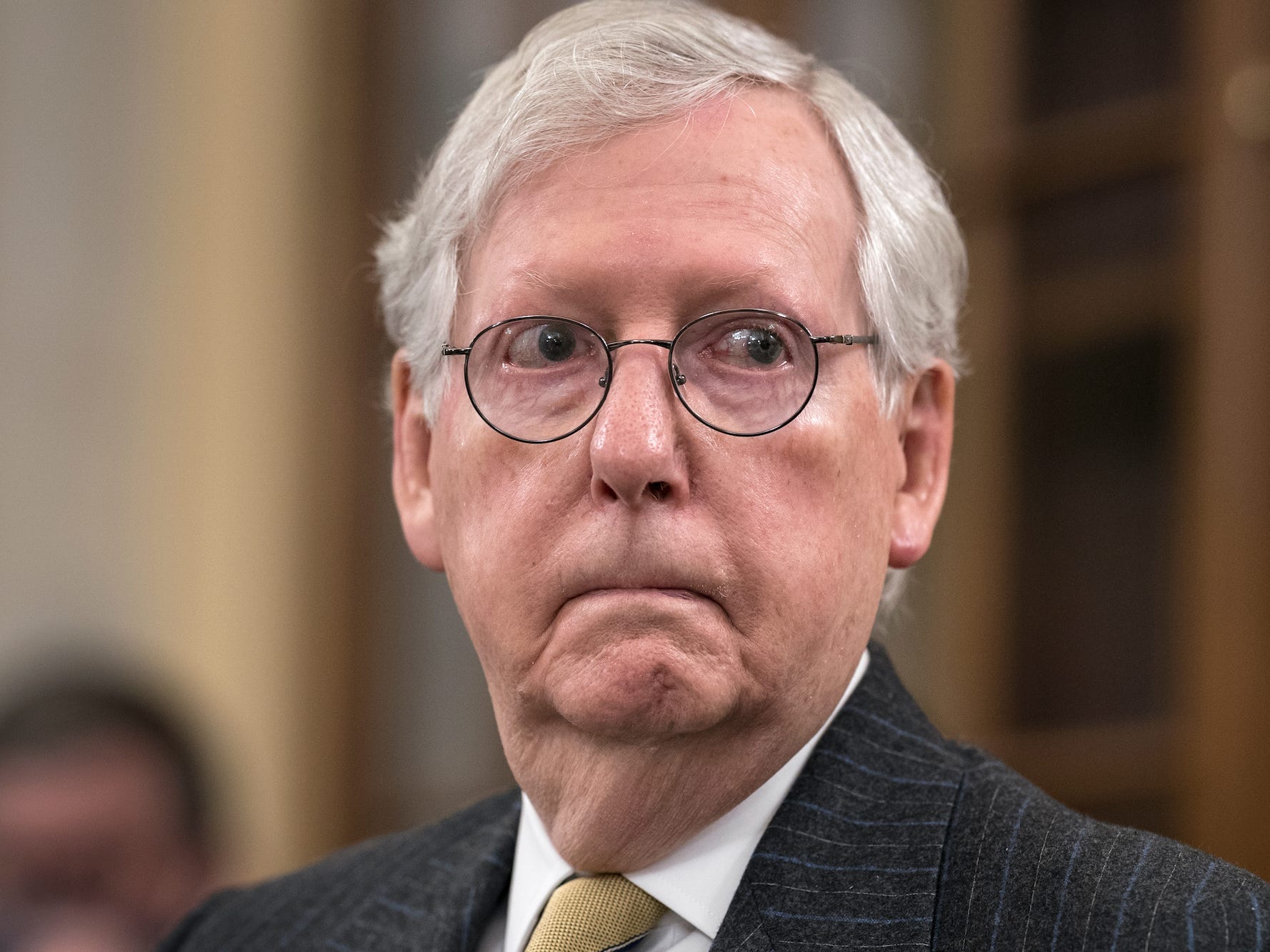

Senate Minority Leader Mitch McConnell echoed the CEOs on Tuesday, saying a reversal from Trump's policy will do far more harm than good.

"This tax bill of 2017 undone would create an extensive loss of jobs in our country, do exactly the wrong thing, and move us in the wrong direction."

Economists largely disagree. The previous president's cuts padded balance sheets while doing little to solve tax avoidance, Nobel laureate Paul Krugman said in a New York Times blog post published Friday.

Strong demand, not lower tax rates, was the primary factor lifting business investment after 2017, economists at the International Monetary Fund said in a 2019 paper. The investment response to the 2017 cuts was also smaller than those seen after previous cuts, they added.

Scott J. Applewhite/AP

What happened to the rocket fuel?

To be exact, Trump deemed his tax cuts "rocket fuel for our economy" that would kickstart a "rebirth of American industry." That rebirth did not arrive, as evidenced by various indicators of economic growth and labor-market health.

To start, connecting the tax cut to the record-low unemployment rate seen before the pandemic ignores several previous years of growth. The expansion that ended in March 2020 predated Trump by several years and was the longest in US history; job creation from 2012 to 2019 trended at about 2 million to 2.5 million nonfarm payrolls per year.

And after the 2017 tax cut? Job gains in 2018 were only slightly higher than those seen the year prior, and they actually went down in 2019 to the lowest since 2011, signaling the tax cut didn't spark a hiring spree.

The unemployment rate tells a similar story. The headline gauge's pace of decline was roughly the same after 2017 despite Republicans touting the cuts as a boon for the labor market.

Trump also claimed his tax policy would supercharge business investment, but data details an increase that paled in comparison to prior expansions. Domestic business investment climbed by roughly $251 billion from the first quarter of 2017 to its peak in the first quarter of 2019. Yet gains were just as large and more sustained during the dot-com boom of the 1990s and in the immediate wake of the financial crisis.

Productivity did increase in the years after the tax cut, but the trajectory only tells half of the story. The gauge - which measures output per hour of labor - remains well below levels seen just before the financial crisis and the peak seen after the 1990s expansion.

As for Biden and his corporate tax hike? He's arguing for an expanded definition of infrastructure that includes mass availability of high-speed broadband and an electrified federal fleet. Time will tell whether the policy can drive the kind of growth Trump promised, or the kind that corporate leaders are still claiming was exceptional, data notwithstanding.

But with the Biden administration claiming its infrastructure plan will create millions of jobs, Democrats argue it's high time the government gets its shot at providing the kind of "rocket fuel" that could create a stronger economy.